Good Morning! Today in your weekly dose of Natural Capital and NatureTech we’re deep diving into Genomines recent $45Mn Series A led by Engine Ventures & Forbion BioEconomy. Read on for more.

In today’s edition:

🔮 Genomines - Mining Nickel with Plants

💰 $50M+ in new deals

💼 The latest news across Big business, Finance and Tech

💬 The Challenge

The energy transition is a metals transition, decarbonisation technologies demand significant volumes of metals and minerals. Electric cars need 6x the mineral inputs of conventional cars. An offshore wind plant requires 13x more mineral inputs than a similarly sized gas-fired plant.

Nickel plays a critical role in our day to day lives. About 70% of nickel demand is used for making stainless steel in the construction industry. It's also crucial for EV batteries and for specialty alloys in renewables.

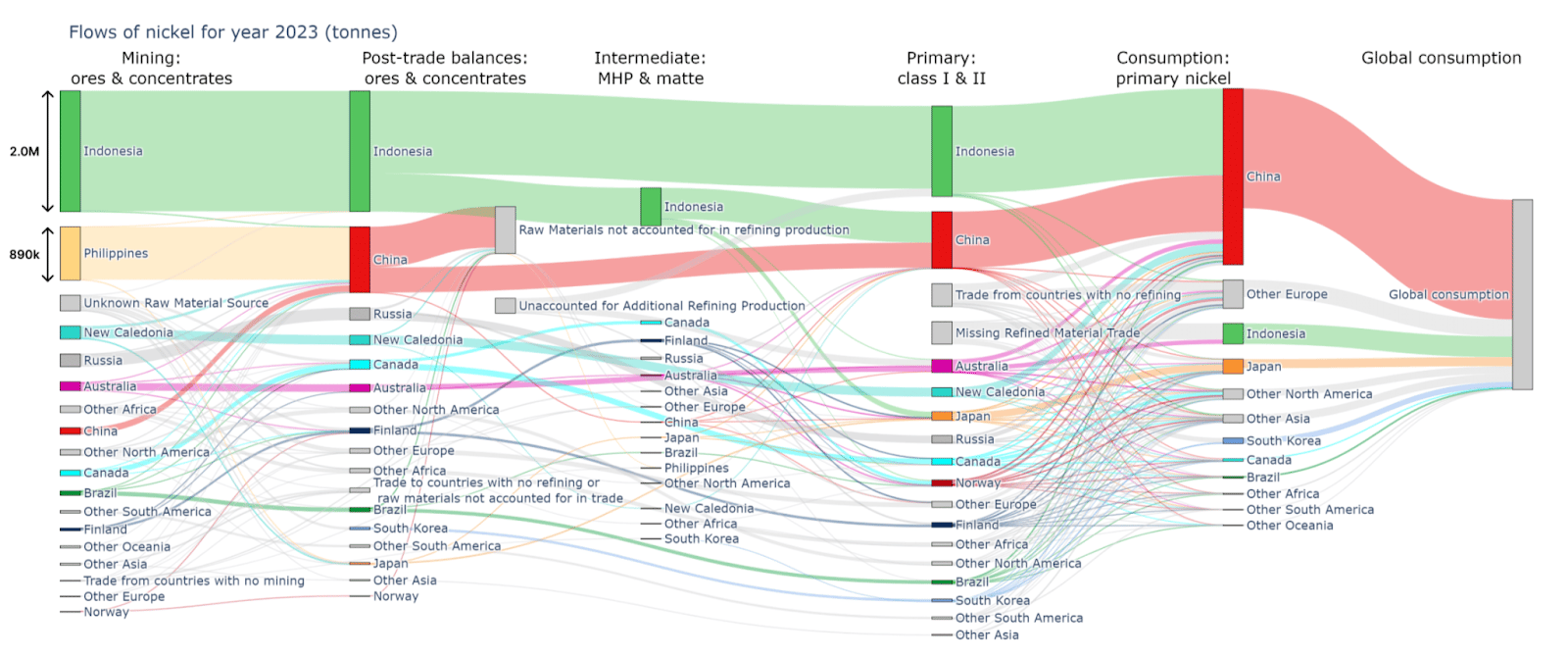

Massive capacity additions from new mines in Indonesia has driven Nickel prices down and concentrated the supply chain in fewer geographies. Massive expansion of mines in Indonesia added 1.5 million tonnes of new capacity forcing the market into oversupply and contributing to prices crashing from over $48,000/tonne in 2022 to around $15,300/tonne today—a 67% decline. Indonesia now controls 60% of supply.

Price declines have challenged the economics of many Western Nickel mines. Most easily mined global reserves are already in use. New projects are increasingly remote, deeper, and economically marginal— current prices mean 30+% of global supply is unprofitable and many Western producers are shuttering or exiting their Nickel facilities.

At the same time, governments and manufacturers are increasingly concerned with creating local, resilient supply chains of metals. Indonesia controls 60% of supply. China controls 68% of downstream processing capacity despite producing only 3% of mined nickel, offering significant control over battery supply chains. Western geographies are looking to secure local supply.

The question for many governments & manufacturers is how can they develop new, cost-competitive, and resilient Nickel supply chains in geographies closer to home?

⛏ Enter Phytomining: Growing Nickel in Plants

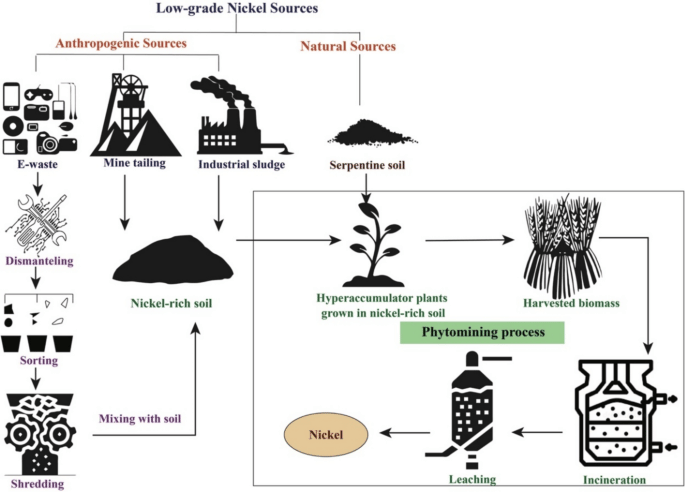

Step 1: Engineering the Plants: Genomines enhance naturally occurring hyperaccumulator plants using gene editing. These plants extract metals from low-grade soil that traditional mining cannot access economically—creating net new supply.

Step 2: Site Selection - The "Goldilocks Zone" These nickel laterite soils exist across 30-40 million hectares globally in the tropical belt— Philippines, New Caledonia, Brazil, West Africa, Cuba, Papua New Guinea, and Australia. Genomines must acquire or lease land where soils are too dispersed and low grade for conventional mining but are too metal rich for traditional agriculture.

Step 3: Harvest: Plants grow for 4-6 months absorbing nickel through roots, then get processed to create nickel-rich material costing $10,000/ton versus $16,000 for traditional mining. Taking a conservative 0.5 tonnes of nickel per hectare per year. This means to account for 1% of global supply (35,260 tonnes) Genomines would require 70,520 hectares of land - roughly the size of Ireland or the state of Georgia.

Step 4: Market & Trade: Sell battery-grade metal produced to automakers and battery manufacturers. New nickel farms can start producing for sale in 1-2 years instead of 12-17 years for traditional mines, operating on low-value land.

🏢 Company Overview

Founded: August 2021 | Location: Paris, France | Team: 23 people

Founders: Fabien Koutchekian (CEO, mining engineer) + Dr. Dali Rashid (CTO, plant scientist with published research on metal-absorbing plants)

Latest Funding: September 2025 | $45 million led by Engine Ventures & Forbion BioEconomy

Total Funding: $62 million (includes $5M first round + $12M in government grants from France)

Major Investors: Engine Ventures, Forbion, Hyundai Motor Group, Lowercarbon Capital, DeepTech & Climate Fonds, Wind Ventures

Progress:

Expanding test farm in South Africa

Working on pilot with strategic customers/investors Hyundai and Jaguar Land Rover

Genetic engineering of plants has more than doubled nickel yields Vs unmodified plants

Goal for 2030: 150,000 tons per year (4% of global supply)

Exploring other revenue streams such as licensing to mining groups

Competitors

Metalplant: Commercializes nickel phytomining and carbon capture via enhanced rock weathering, backed by ARPA-E grants and operating multiple field sites.

Econick: French pioneer in nickel phytoextraction for stainless steel production, partnering with Aperam and leveraging academic expertise.

Smart leaders don’t write books alone.

You built your business with a team. Your book should be no different.

Author.Inc helps founders and executives turn their ideas into world-class books that build revenue, reputation, and reach.

Their team – the same people behind projects with Tim Ferriss and Codie Sanchez – knows how to turn your expertise into something that moves markets.

Schedule a complimentary 15-minute call with Author.Inc’s co-founder to map out your Book Blueprint to identify your audience, angles, and ROI.

Do this before you commit a cent, or sentence. If it’s a go, they’ll show you how to write and publish it at a world-class level.

If it’s a wait, you just avoided wasting time and money.

🚀 Tailwinds

Plays into resource nationalism megatrend: U.S. tariffs of 25%-40% on metal imports from over 150 countries, effective August 1, 2025, have reshaped nickel trade flows. Phytomining can open up supply in "friendly" jurisdictions such as Australia.

CAPEX light vs other metals extraction technologies offers flexibility in production in response to downturns in Nickel price. Sites can scale modularly, deploying smaller, capital-efficient assets that get to first extraction in 1-2 years. Land can be used for other crops in metals downturns.

Having Hyundai as a strategic investor is validation from one of the world’s largest automakers. Their backing serves as a signal that “blue chip” global automakers want to make their battery supply chains both more resilient and more compliant with emerging US and EU regulations.

🌬️ Headwinds

Commodity price exposure, and battery tech substitution risk. Some battery types (called LFP) could cut nickel demand by 33% by 2030, while newer sodium-ion batteries don't use nickel at all—if these alternatives grow faster than predicted, oversupply could continue to drive prices down. This would erode phytomining companies' cost advantage Vs traditional mining.

Land acquisition and adoption amongst marginal land-owners Success requires access to Nickel-rich soils. While an estimated 30-40 million hectares might have enough nickel, these companies need to negotiate with landowners, get government permits, respect indigenous peoples' rights, and avoid conflict with food creation —starting fresh in each new country. No easy feat.

Consistent yields across diverse agricultural systems. In trials plants have produced double the required amounts for economic extraction. However, growing crops consistently in real fields faces unknowns around plant diseases, different soil types, and weather— most land-owners will want to see results from the ‘field next door’ before they sign up to a trial.

Summary

In our view, the company that "wins" phytomining will not be the one with the best genetic engineering—it will be the organisation who moves fastest to lock up the most promising 1% of global nickel laterite soils, and is the best at operating those sites to maintain target yields.

With 46Mn in fresh funding to support land acquisition, and first-mover advantage on tech - we’re excited to see how Genomines scales.

We’d love to hear your perspective. What did we miss? Please get in touch

🛗 Snippets for your lift conversations

💻 Tech:

Inaudible sound might be the next frontier in wildfire defence (Read more)

Strong by Form will show its ultralight engineered wood at TechCrunch helping to curb construction related emissions (Read more)

💼 Big business:

Bill Gates publishes a notes on the need to focus less on carbon emissions and temperature change and more on improving lives (Read more)

Amazon to sell carbon credits to suppliers, customers (Read more)

🏦 Finance:

Climate fund backs $6 billion Jordan water project with its largest deal (Read more)

Environmental Finance has published its Natural Capital Insight 2025, highlighting how investors are factoring nature-related risks and identifying investments to protect nature. (Read more)

📝 Policy:

Australia and the US signed a $2bn joint critical minerals agreement to counter China’s control over global supply chains and strengthen Western access to rare earths and battery metals. Each government will invest $1bn in mining and processing projects targeting critical mineral deposits worth $53bn. (Read more)

The European Commission proposed a further softening of the EU anti-deforestation law, relieving the reporting burden for many smallholders and businesses, but stepping back from delaying the world-first green policy by another year. (Read more)

UK Government publishes first national plan to train up next generation of clean energy workers, as part of push to fill 830,000 roles across the sector by 2030. (Read more)

Thailand will begin mandating Sustainable Aviation Fuel use, starting at 1% in 2026 and rising to 8% by 2036, while restructuring road fuels around Gasohols and Biodiesels (Read more)

🎣 Deals

🇺🇸 Redwood Materials raised $350.0M (Series E) for their battery recycling process that recovers metals from spent EV batteries Source

🇳🇱 TRACT raised $21.7M (Series A) for their software platform to measure sustainability performance across food and agriculture industries Source

🇬🇧 Mondra raised $13.4M (Series A) for their digital footprinting platform that enables supply chain decarbonisationSource

🇩🇪 aevoloop raised $9.3M (Seed) for their closed-loop plastic recycling solutions Source

🇫🇷 Nutropy raised $8.2M (Seed) for their precision fermentation to produce animal-free milk proteins for the cheese industry Source

🇬🇧 Upp raised $2.0M (Seed) for their technology that upcycles broccoli waste into plant-based protein Source

🇮🇳 Happi Planet raised $2.0M (Early VC) for their sustainable home care and personal care products Source

🇵🇹 Seaforester raised $1.9M (Seed) for their innovative sea forestation techniques to reverse ocean acidification Source

🇮🇳 Megaliter Varunaa raised $1.7M (Seed) for their decentralized wastewater treatment and recycling services Source

🇬🇧 SAGES raised $254K (Series A) for their sustainable color solutions for the textile industry Source

🇯🇵 Umami United raised $21K (Series A) for their plant-based egg products Source

These deals were brought to you in partnership with Net Zero Insights.

Are you planning a fundraise? 50+ Startups are raising >$100mn in our network this year. Get in touch to hear more.

📆 Events

🇺🇸 Greenbuild International Conference & Expo 2025-11-04 (Attend)

🇪🇸 Smart Cities Expo World Congress 2025-11-04 (Attend)

🇵🇱 Food Tech Congress 2025 2025-11-05 (Attend)

🇪🇸 Tech Tour Tomorrow.Blue Economy 2025 2025-11-06 (Attend)

🇵🇹 Web Summit 2025-11-10 (Attend)

🇬🇧 Future of Utilities: Smart Energy 2025-11-11 (Attend)

🇺🇸 Blue Tech Week 2025-11-11 (Attend)

🇩🇪 Green Manufacturing Conference 2025-11-12 (Attend)

🇩🇪 Greener Manufacturing Show 2025-11-12 (Attend)

🇩🇪 Sustainable Materials Expo 2025-11-13 (Attend)

🇫🇮 Slush 2025-11-19 (Attend)

🇧🇷 United Nations Climate Change Conference 2025 2025-11-21 (Attend)

📩 Written by Ollie and Pat. Feel free to send us deals, announcements, or anything else using the link below or via LinkedIn.